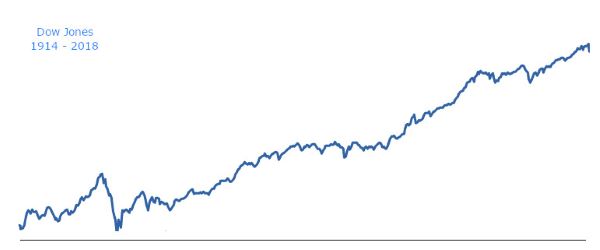

Over the past century, the stock market has been a prime example of the compounding effect in action, demonstrating how small investments can grow into substantial wealth over time, even while investors sleep.

The stock market's historical performance showcases the power of compounding. Despite occasional downturns and fluctuations, the overall trend of the market has been upward over the long term. This means that investments made in quality stocks, diversified portfolios, or index funds have generally grown in value over time, driven by factors such as economic growth, technological advancements, and corporate innovation.

Consider an investor who put money into the stock market 100 years ago. Despite the market's ups and downs, the compounding effect would have worked in their favor. Over the decades, dividends would have been reinvested, stock prices would have appreciated, and overall portfolio value would have increased substantially.

Warren Buffett, one of the most successful investors of all time, often emphasizes the importance of patience and compounding in wealth creation. He famously said, "The stock market is designed to transfer money from the active to the patient." This statement encapsulates the idea that those who stay invested for the long term and allow their investments to compound over time tend to outperform those who try to time the market or engage in frequent trading.

The notion of "making money while you sleep" perfectly encapsulates the essence of the compounding effect in the stock market. Unlike active income, where you exchange time and effort for money, passive income generated from investments allows you to earn money without actively working for it. Dividends, interest, and capital gains from stocks can continue to grow and generate income even when you're not actively monitoring your investments.

In conclusion, the relationship between compounding and the stock market's 100-year history underscores the incredible wealth-building potential of long-term investing. By harnessing the power of compounding and staying invested through market cycles, investors can potentially achieve their financial goals and make money work for them, even while they sleep.

Have you ever tried using this compound interest calculator?