An ABA number, also known as a bank routing number, is a nine-digit code that uniquely identifies financial institutions in the United States. These numbers play a crucial role in facilitating various financial transactions, including:

-

Wire Transfers: When you need to transfer funds from one bank to another, the ABA number ensures that the money reaches the correct financial institution.

-

Direct Deposits: Employers use ABA numbers to deposit salaries directly into employees’ bank accounts.

-

Automatic Bill Payments: ABA numbers enable automatic payments for bills, subscriptions, and other recurring expenses.

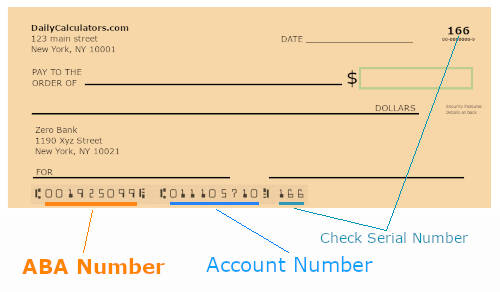

You can find your bank’s ABA number printed on your personal checks or within the information portal of your online banking account. It’s typically located at the bottom left-hand corner of a check.(How to write a check)

These nine digits are like a bank’s unique identification code, ensuring smooth and accurate financial transactions.

Who is responsible for issuing ABA numbers to financial institutions?

The American Bankers Association (ABA) is the organization responsible for issuing ABA numbers, also known as routing transit numbers (RTNs), in the United States. These unique nine-digit codes are printed on the bottom of checks and serve to identify the financial institution on which the check was drawn. The ABA developed this system in 1910 to facilitate the sorting, bundling, and delivery of paper checks to the drawer’s (check writer’s) bank for debit to the drawer’s account. Additionally, newer electronic payment methods continue to rely on ABA RTNs for identifying the paying bank or other financial institution. The Federal Reserve Bank uses ABA RTNs in processing Fedwire funds transfers, and the ACH Network also relies on them for processing direct deposits, bill payments, and other automated money transfers1.

Since 1911, the American Bankers Association has partnered with a series of registrars, currently Accuity, to manage the ABA routing number system. Accuity serves as the Official Routing Number Registrar and is responsible for assigning ABA RTNs and maintaining the ABA RTN system. They publish the American Bankers Association Key to Routing Numbers semi-annually, which contains a listing of all assigned ABA RTNs. Currently, there are approximately 26,895 active ABA RTNs in use, with each financial institution having at least one assigned. Some institutions may have more than five ABA RTNs due to mergers. It’s important to note that ABA RTNs are used exclusively for payment transactions within the United States, including paper checks, wire transfers, and ACH transactions.

What are best ways to find ABA number of your bank account

The ABA number is essential for various financial transactions. Here are some ways to find it:

-

Check Your Personal Checks: Look at the bottom of one of your personal checks. Your account number is on the bottom right, and directly to the bottom left of your account number, you’ll find the nine-digit routing number.

-

Bank Statements: If you don’t have checks handy, check your bank statement. The routing number is usually printed near your account number.

-

Online Banking: Log into your online banking account. Most banks provide the routing number there. You can also visit your bank’s website and navigate to the direct deposit or ACH section.

-

Contact Your Bank: If all else fails, call your bank or visit a branch. They can provide your routing number.